International Clearing Membership (ICM)

List of International Clearing Members

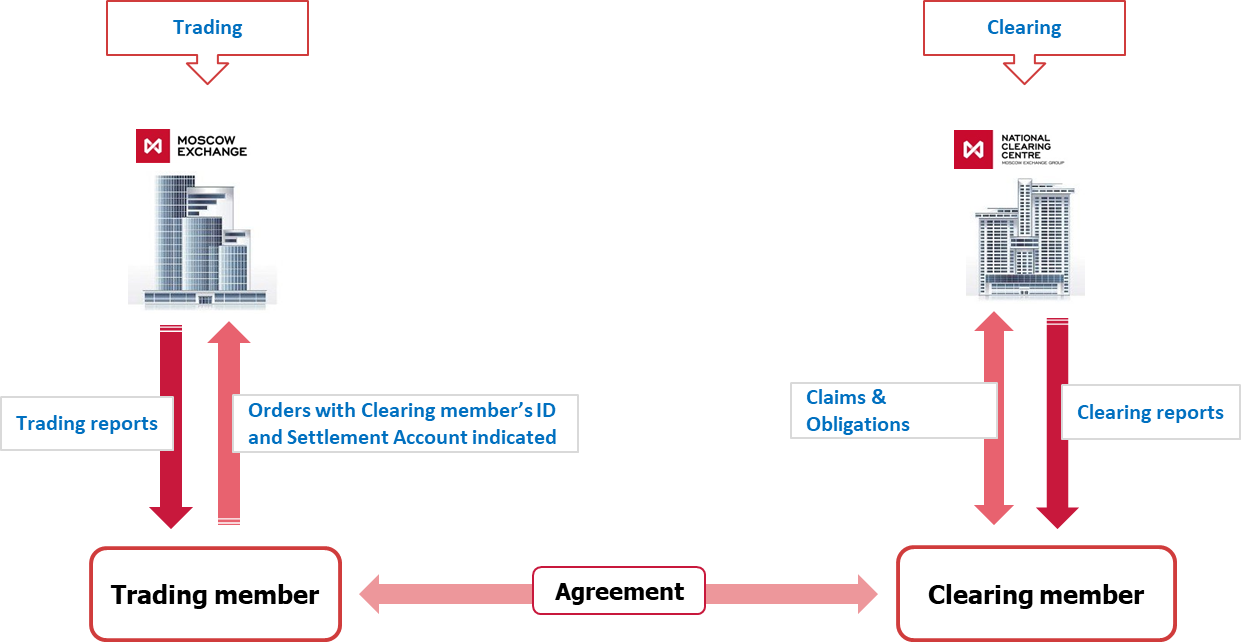

Trading and Clearing members may now be separate entities. Trading members have to be Russian residents, but Clearing members can be domestic or foreign.

This new model allows for:

- End clients (including non-residents) to hold their capital directly with the NCC (National Clearing Centre - the central clearing house of MOEX markets) instead of a domestic broker, and therefore take less credit risk.

- Non-residents to have naked access to the Exchanges systems (through the use of SMA logins), and therefore avoid latency penalties from brokers infrastructure.

- Clients more flexibility on where they can execute their trades and clear their positions.

This new model was implemented in 2014 on the MOEX FX Market, and planned for implementation in 2019 on the Derivatives and Equities Market.

The National Clearing Centre Facts:

The NCC is a resilient and recognized central counter party.

The NCC was granted the status of a qualified CCP by the Central Bank of Russia on October 18, 2013.

| NCC is an active member of the European Association of Central Counterparty Clearing Houses (EACH) | |

| АCRA | On October 24, 2017, the Analytical Credit Rating Agency (ACRA) affirmed the rating of AAA(RU) for the NCC, with a forecast of 'Stable' |

| The NCC is a member of the Global Association of Central Counterparties (CCP12) | |

| On February 22, 2017 Fitch Ratings affirmed the NCC as a long-term foreign currency issuer with a default rating at "BBB-", local currency rating at "BBB'. |

Clearing Member Categories:

| Categories: | FX + Precious Metals Market |

Equities Market |

Commodities Market |

Derivatives market |

Standardized Derivatives |

|

|---|---|---|---|---|---|---|

| O | General Clearing Members: having access to clearing with partial prefunding for more than 2 trading members | + | + | - | + | - |

| B | Individual Clearing Members: having access to clearing with partial prefunding for up to 2 trading members | + | + | + | + | + |

| C | Individual Clearing Members: having access to clearing with full prefunding for up to 2 trading members | + | + | + | - | - |

Admission Criteria:

| Category C | Category B | Category O |

|---|---|---|

| Signing the Clearing Membership agreement | All requirements of category C, plus: | All requirements of category B and C, plus: |

| Compliance with Disclosure & Reporting requirements | Having sufficiently contributed to the Default fund | Appropriate license, and/or |

| Compliance with the Financial solvency requirements | Having all necessary licenses, or at least 50 bln RUB capital + rating not lower than

|

Capital of at least 50 bln RUB |

| Compliance with Technical access requirements | Not bearing signs of financial weakness | Or 20 bln RUB + a rating not lower than:

|

| Holding all necessary licenses, or at least 1 bln RUB in capital. | Or 20 bln RUB + rating of a supervising organization not lower than

|

Additional Info:

- Presentation of the service

- Presentation on NCC Risk Management on Derivatives market

- NCC Clearing and Settlement Overview

- Changes in SPECTRA Plaza-2 gate (section 2.7)

- Segregated accounts

Contacts

- International business – globalexchange@moex.com

- Development and support of clearing services ps@moex.com, +7 (495) 363-3232

- Tech support – help@moex.com

- Segregated accounts – segregation@moex.com

- Sales Department, Equities market – equities@moex.com

- Sales Department, FX market – +7 (495) 363-3232

- Sales Department, Derivatives Market – derivatives@moex.com